Getting Started with Guernsey Payroll

Your complete guide from first login to running your first payroll

Login & Security Setup

Welcome to Guernsey Payroll! Let's get you started with accessing your account and setting up essential security features.

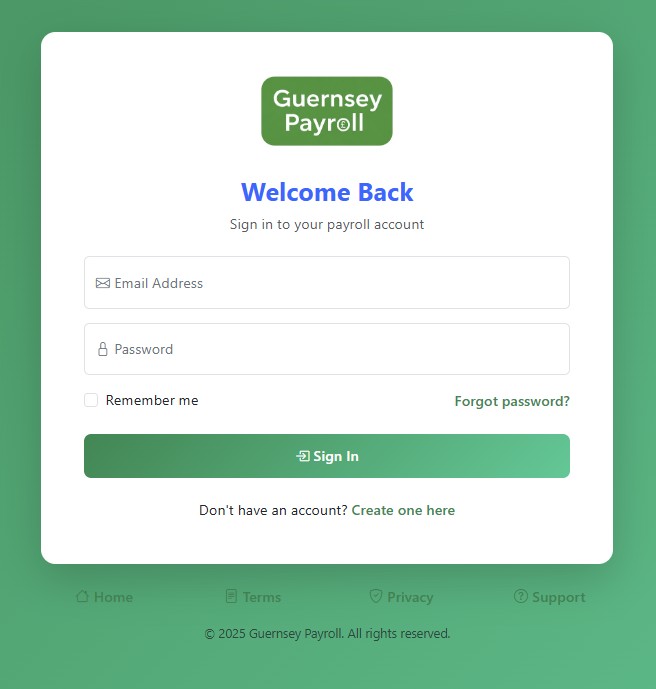

Initial Login

Access Your Account

Navigate to your Guernsey Payroll login page and enter the credentials provided during your account setup. If you haven't received your login details, contact our support team.

Change Your Password

On first login, you'll be prompted to change your password. Choose a strong password with at least 8 characters, including uppercase, lowercase, numbers, and special characters.

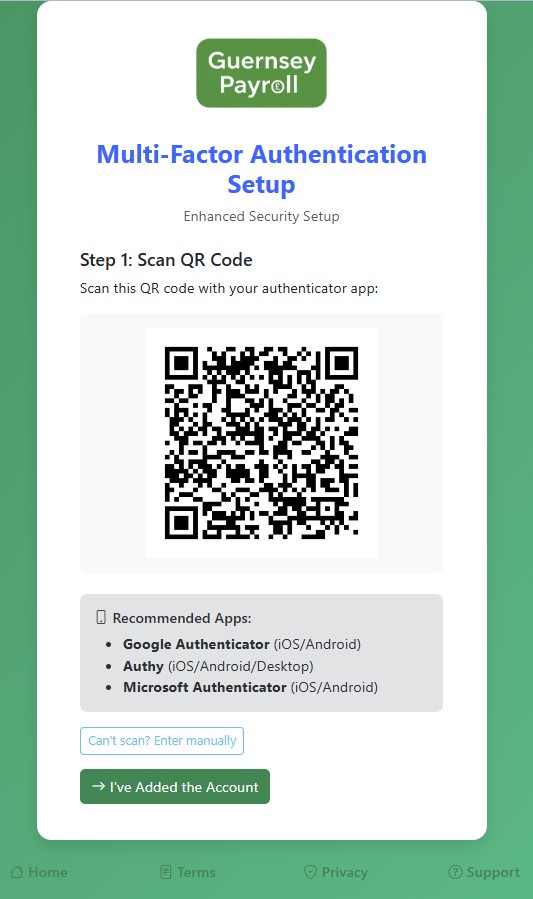

Multi-Factor Authentication (Recommended)

For enhanced security, we strongly recommend enabling Multi-Factor Authentication (MFA). This adds an extra layer of protection to your payroll data.

Enable MFA

Go to Settings → Security → Multi-Factor Authentication. Click "Enable MFA" to start the setup process.

Install Authenticator App

Download Google Authenticator, Microsoft Authenticator, or Authy on your mobile device. Scan the QR code displayed on screen.

Verify Setup

Enter the 6-digit code from your authenticator app to complete MFA setup. Save your backup codes in a secure location.

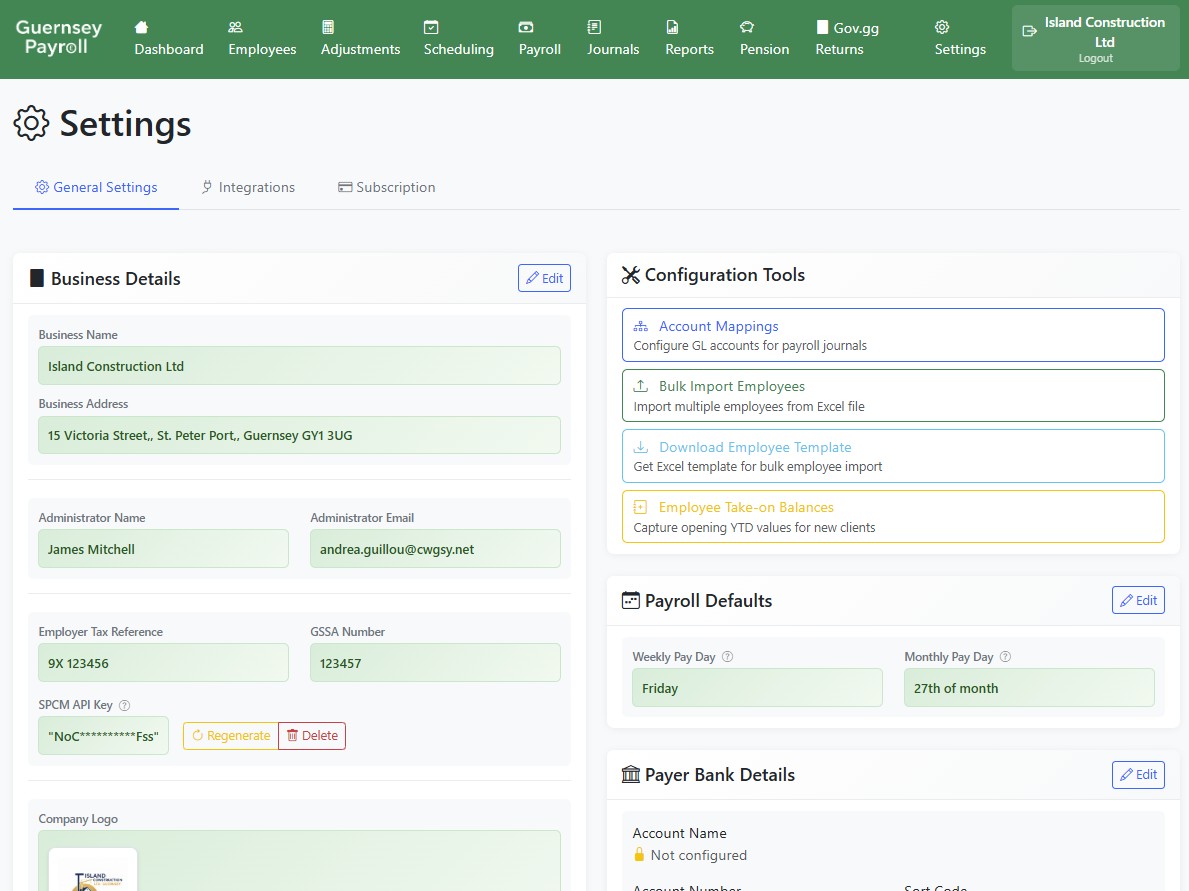

Configure Business Settings

Before processing any payroll, you need to configure your business information and payroll settings. This ensures accurate calculations and compliance.

Essential Business Information

Company Details

Navigate to Settings → Business Information. Enter your company name, address, and contact details. This information appears on payslips and reports.

Tax Registration

Enter your Guernsey Social Security Number and Employer Tax Reference. These are essential for government compliance and quarterly returns.

Payroll Frequency

Set your default payroll frequency (Weekly or Monthly). You can process different frequencies as needed, but this sets your primary schedule.

Tax and Contribution Settings

Guernsey Payroll automatically uses current Guernsey tax rates, and are set automatically beore each year end.

Income Tax

Current rate: 20%

Social Security (GSSA)

Employee: 7.4%

Employer: 7.0%

LEL (weekly): £184/week

Secondary Pensions (2025)

Minimum Employee: 1%

Minimum Employer: 1%

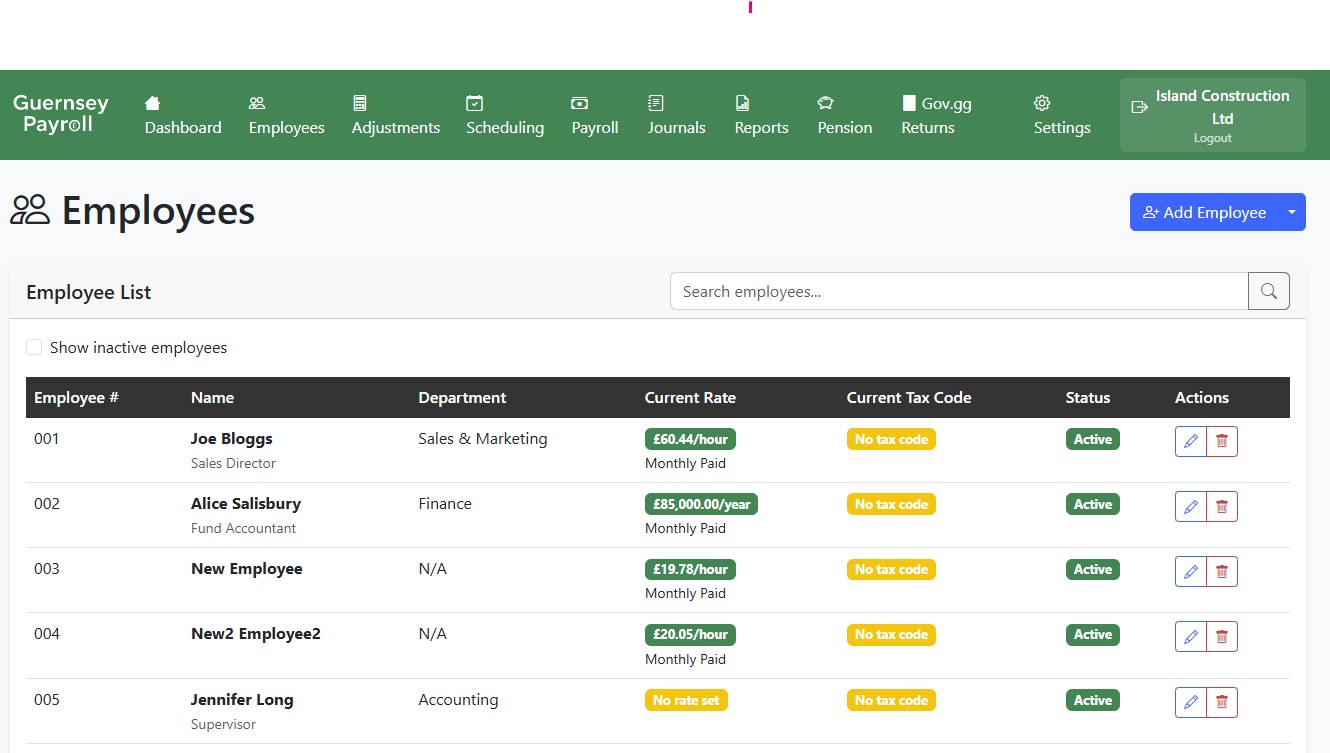

Add Your Employees

Now it's time to add your employees to the system. You can add them individually or import from a spreadsheet.

Adding Individual Employees

Navigate to Employees

Click "Employees" in the main navigation menu, then click "Add New Employee" to start adding your first employee.

Personal Information

Enter the employee's full name, date of birth, address, and contact details. All personal information is encrypted for security.

Employment Details

Set their employee number, start date, pay frequency, and hourly rate or salary. Set their tax code as notified by the Revenue Service.

Bank Details

Enter their bank account details for salary payments. This information is also encrypted and secure.

You're All Set!

Congratulations on setting up Guernsey Payroll. You now have a complete payroll system that handles calculations, compliance, and reporting automatically.